Financials

Financials

CONDENSED INTERIM FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

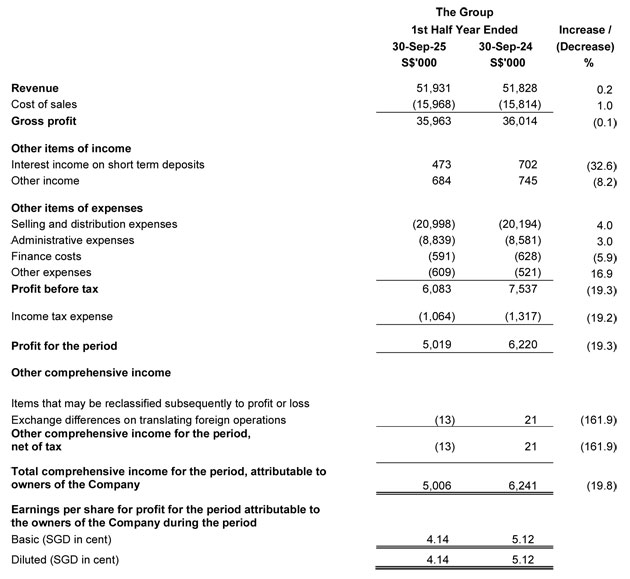

Condensed interim consolidated statement of comprehensive income for the six-months ended 30 September 2025

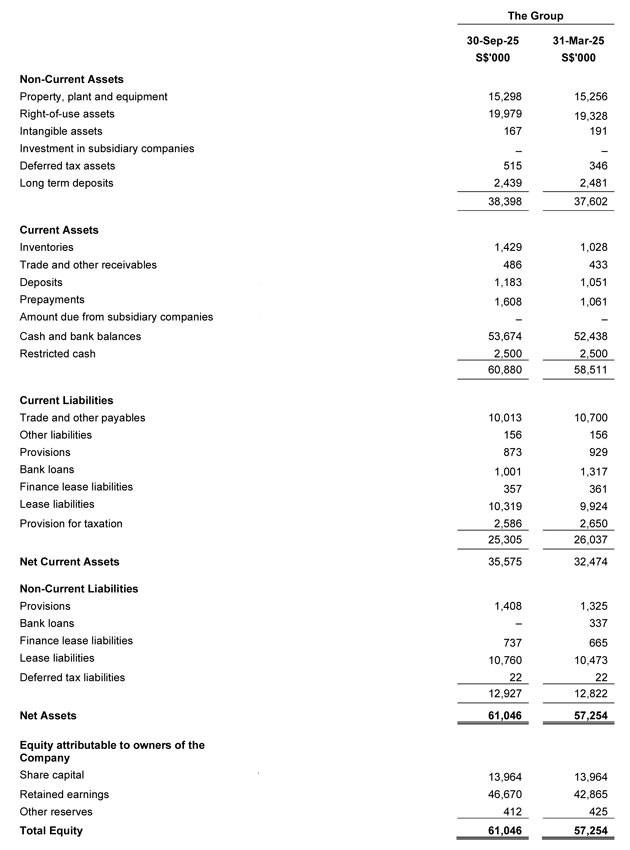

Condensed interim statement of financial position

(A) Statement of Comprehensive Income

For the period from 1 April 2025 to 30 September 2025 ("1H2026"), the Group's revenue increased by approximately S$0.1 million or 0.2%. This increase in revenue arose mainly due to higher retail and non-retail sales.

Revenue from retail outlets increased by approximately 0.1% due to incremental contributions from new and existing outlets, partially offset by the absence of revenue from outlets under refurbishment and the closure of certain outlets.

Revenue from other services, such as delivery, catering services and non-retail sales, increased by approximately 1.0%. The increase in revenue from other services arose primarily due to higher delivery sales, corporate catering and events sales during 1H2026, partially offset by absence of revenue from a corporate customer that contributed in the previous period.

The Group's gross profit margin declined by 0.2% to 69.3% in 1H2026, mainly due to higher food costs and increased production staff expenses. These were partially offset by a reduction in production utility expenses during the current period.

Other income declined by approximately S$61,000 or 8.2% mainly due to lower gains from the disposal of vehicles and reduced government grants, partially offset by higher employment grants received for 1H2026.

Interest income on short term deposits declined by approximately S$0.2 million, primarily due to lower interest rates from short-term fixed deposits placements.

Selling and distribution ("S & D") expenses increased by 4.0%, driven by higher staff costs from annual wage adjustments and higher local starting salaries due to the continuing progressive wage model policy by the Singapore Government, higher depreciation arising from new and refurbished outlets, and higher subcontractor expenses, partially offset by lower utility expenses during 1H2026. As a percentage of revenue, total S & D expenses increased slightly from 39.0% to 40.4%.

Administrative expenses increased by 3.0%, mainly attributable to increase in staff welfare and insurance expenses, higher bank merchant fees arising from digital payments and higher repairs and maintenance expenses, partially offset by lower legal and professional expenses for 1H2026.

Finance costs decreased slightly by approximately S$37,000 mainly due to lower interest expenses on bank loans due to repayments for 1H2026, partially offset by finance charges on new and renewed lease liabilities.

Other expenses rose mainly due to impairment of trade receivables, and lower foreign exchange gains pursuant to foreign exchange revaluation of inter-company loans to the Group's Australian and Malaysian subsidiaries, partially offset by lower impairment loss on amounts due from the Group's joint venture in United Kingdom for 1H2026.

The increase in depreciation expenses by approximately S$0.3 million was mainly attributable to higher depreciation of right-of-use assets from new and renewed leases of retail outlets, higher depreciation of property, plant and equipment arising from refurbishment works and motor vehicles additions during 1H2026.

The Group's taxation expenses decreased by approximately S$0.3 million, mainly due to the lower profits before tax, partially offset by the reversal of deferred tax expenses for 1H2026.

(B) Statement of Financial Position

Non-current assets

The Group's non-current assets increased by approximately S$0.8 million mainly due to:

- an increase in property, plant and equipment arising from capital expenditure incurred for renovations and additions of equipment for outlets, partially offset by depreciation expenses during 1H2026;

- an increase in right-of-use assets arising from new and renewed leases entered into during the period, partially offset by right-of-use depreciation expenses; and

- an increase in deferred tax assets mainly due to higher temporary differences arising from accrued expenses and property, plant and equipment.

The increase in non-current assets attributable to the factors listed above was partially offset by a decrease in long term deposits arising from reclassification of lease deposits in accordance with the respective lease tenures during 1H2026, which was partially offset by deposits paid for new outlets and lease renewal.

Current assets

The Group's current assets increased by approximately S$2.4 million, mainly due to:

- an increase in inventories of approximately S$0.4 million, arising from bulk purchase of products from overseas suppliers;

- an increase in trade and other receivables arising from credit sales to corporate customers;

- an increase in short term deposits, arising from deposits for new upcoming outlets and reclassification of lease deposits in accordance with the respective lease tenures; partially offset by refund of deposits from closed outlets;

- an increase in prepayments, arising from an increase in annual insurance premium, and new renovation contracts entered into during 1H2026; and

- an increase in cash and bank balances of approximately S$1.2 million. Further details of the changes in the Group's cash flow are set out in paragraph (C) below.

Current and non-current liabilities

The net decrease in the Group's current and non-current liabilities of approximately S$0.6 million was mainly due to:

- a decrease in trade and other payables of approximately S$0.7 million, mainly arising from the payment of accrued employee bonus during the period;

- a decrease in liabilities pertaining to bank loans and finance leases, mainly due to repayments made during 1H2026, partially offset by new finance lease secured for the purchase of motor vehicles; and

- a decrease in tax provision due to lower profit before tax and tax paid during the period.

The decrease in current and non-current liabilities attributable to the factors listed above was partially offset by an increase in lease liabilities mainly due to new and renewed leases entered into, partially offset by lease repayment during the period.

Net working capital

The Group had a positive net working capital of approximately S$35.6 million as at 30 September 2025, compared to a positive net working capital of approximately S$32.5 million as at 31 March 2025.

(C) Statement of Cash Flows

In 1H2026, the Group generated an operating profit before working capital changes of approximately S$13.3 million. Net cash generated from operating activities, inclusive of working capital changes and tax paid, amounted to approximately S$10.2 million in 1H2026.

In 1H2026, net cash used in investing activities amounted to approximately S$0.7 million. This was mainly due to renovation works and equipment for new and existing outlets, partially offset by proceeds from disposal of motor vehicles and interest income received from short-term fixed deposits for 1H2026.

Net cash used in financing activities amounted to approximately S$8.2 million in 1H2026. This was mainly due to the distribution of dividends amounting to approximately S$1.2 million during the period, repayment of lease obligations (inclusive of lease interest) of approximately S$6.1 million, and repayments of bank loans and finance lease during 1H2026.

Commentary

The Group is observing sustained pressure across its cost base, with notable increases in raw material costs, wages and rental expenses. Simultaneously, the structural manpower deficit within the retail industry continues to present a significant operational hurdle, compounded by a period of moderated retail consumer demand in the near term.

In response, the Group is strategically focused on operational resilience. The Group's immediate priorities include rigorous cost management, gross margin enhancement, and operational optimisation to mitigate the impact of manpower constraints. Furthermore, the Group is actively diversifying its revenue mix by accelerating the growth of non-retail revenue streams, such as business-to-business (B2B) sales. The Group is also proactively exploring opportunities to expand its footprint in high-value, strategic locations including transport hubs, while remaining committed to pursuing synergistic opportunities that enhance operational efficiency and scale its logistics and manufacturing capabilities.