A N N U A L R E P O R T 2 0 1 6

42

CORPORATE

GOVERNANCE

Guideline

Code and/or Guide Description Company*s Compliance or Explanation

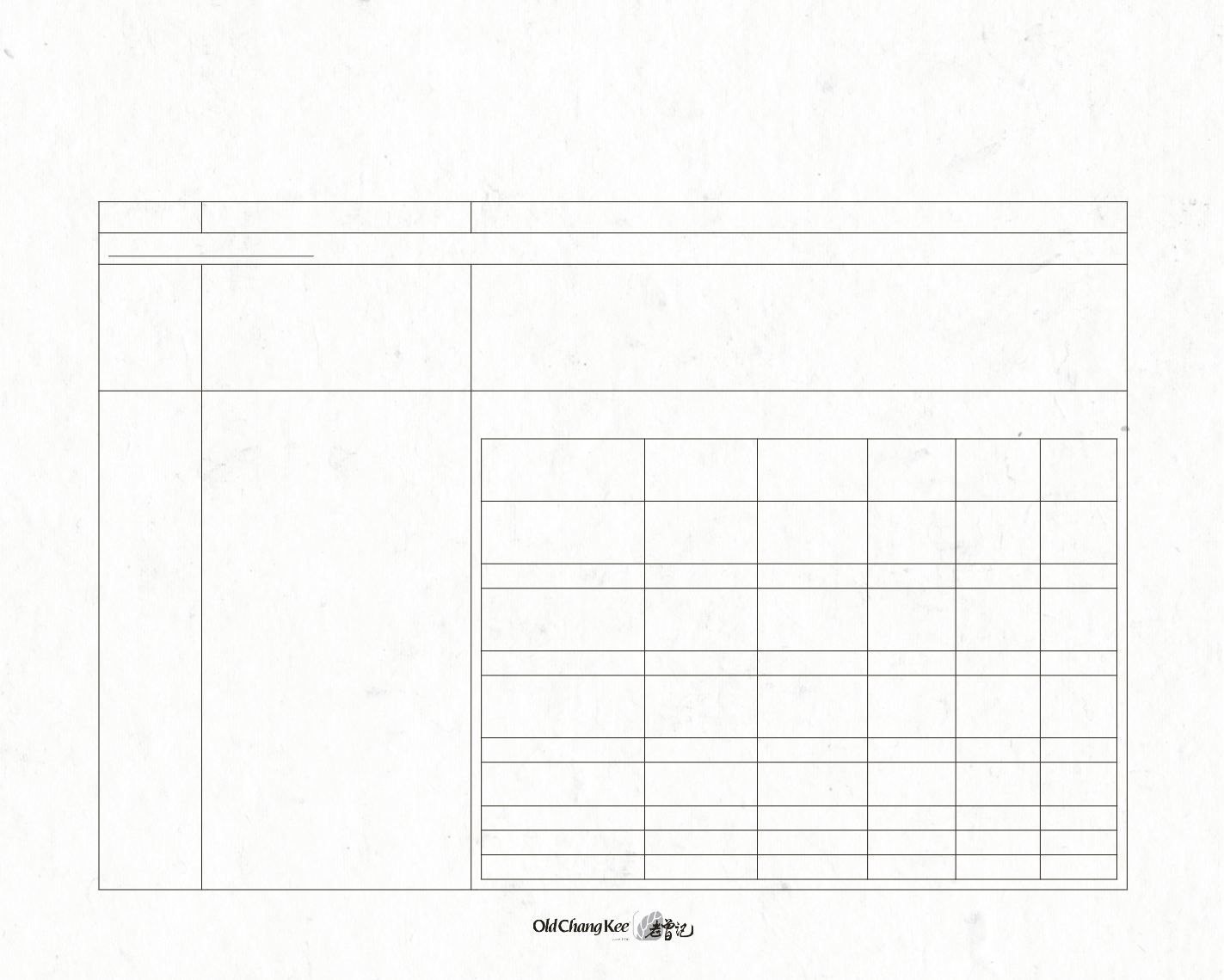

Disclosure on Remuneration

9

Wha t

i s

t he

Company *s

remuneration policy?

The RC will review at least annually all aspects of remuneration, including Directors*

fees, salaries, allowances, bonuses and benefits-in-kind to ensure that the remuneration

packages are appropriate to attract, retain and motivate the Directors to provide good

stewardship of the Company, key executives to successfully manage the Company and

employees capable of meeting the Company*s objectives and that the remuneration

commensurate to such person*s duties and responsibilities.

9.1

9.2

Has the Company disclosed

each Director*s and the CEO*s

remuneration as well as a

breakdown (in percentage or

dollar terms) into base/fixed salary,

variable or performance-related

income/bonuses, benefits in kind,

stock options granted, share-based

incentives and awards, and other

long-term incentives? If not, what

are the reasons for not disclosing

so?

The breakdown for the remuneration of the Directors for FY2016 is as follows:

Name

Fixed

remuneration

(%)

Performance

Bonus (%)

Directors

Fees (%)

Benefits-

in-kind

(%)

Total

(%)

Band VI: Between

S$1,250,001 and

S$1,500,000

Han Keen Juan

57

41

每

2

100

Band V: Between

S$1,000,001 and

S$1,250,000

Lim Tao-E William

57

41

每

2

100

Band III: Between

S$500,001 and

S$750,000

Chow Hui Shien

46

52

每

2

100

Band I: Below

S$250,000

Ong Chin Lin

每

每

100

每

100

Audrey Yap Su Ming

每

每

100

每

100

Zainudin Bin Nordin

每

每

100

每

100