A N N U A L R E P O R T 2 0 1 6

130

NOTES TO THE

FINANCIAL STATEMENTS

For the Financial Year Ended 31 March 2016

33.

Financial risk management objectives and policies (cont*d)

(c)

Interest rate risk (cont*d)

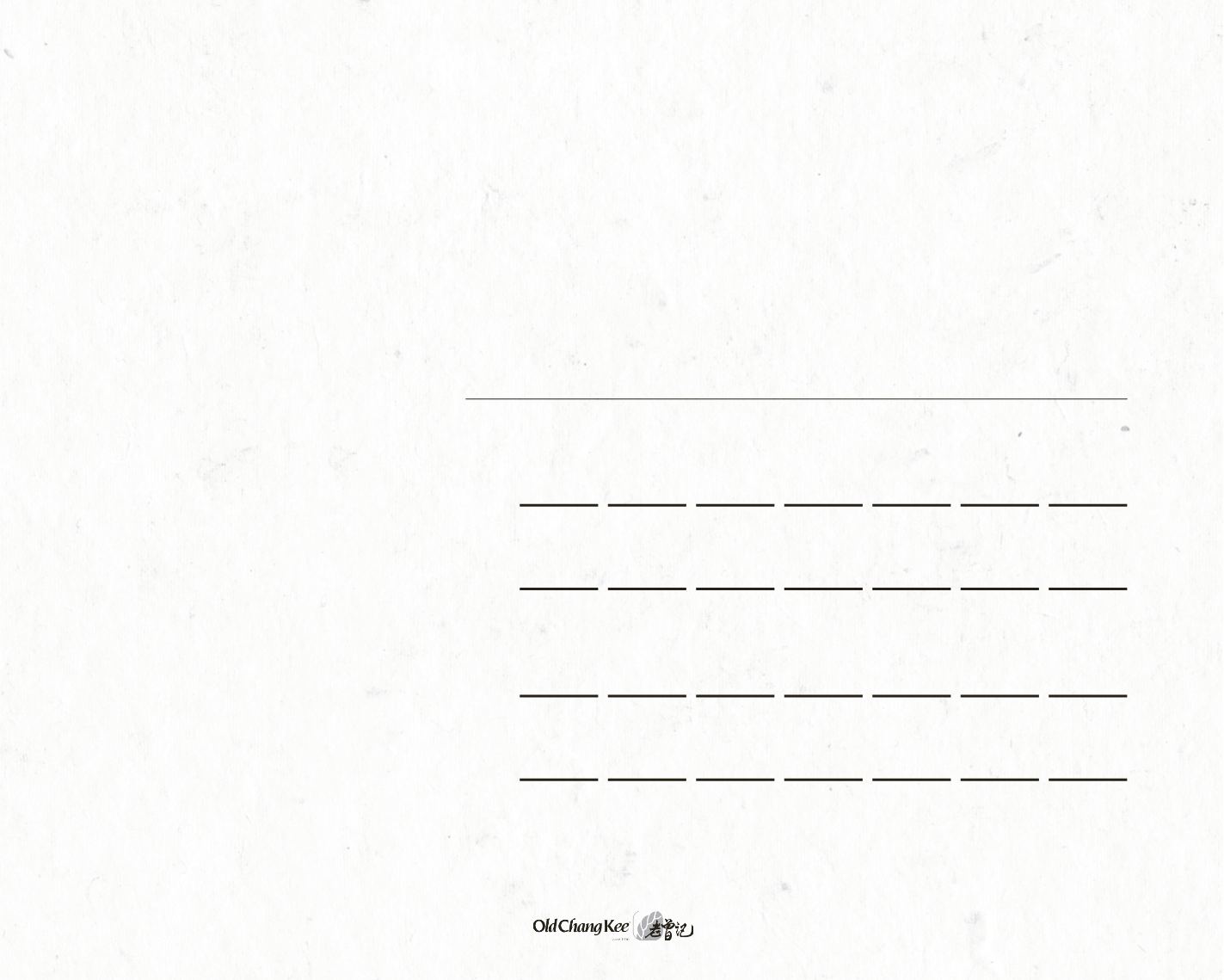

The following table sets out the carrying amounts, by maturity, of the Group*s financial instruments that are exposed to interest rate

risk:

Group

Note

Within

1 year

1 to 2

years

2 to 3

years

3 to 4

years

4 to 5

years

Over 5

years

Total

$*000

$*000

$*000

$*000

$*000

$*000

$*000

2016

Fixed rate

Short-term deposits

21

4,550

每

每

每

每

每

4,550

Obligations under finance leases

30(c)

(112)

(117)

(114)

(46)

每

每

(389)

Floating rate

Cash at banks

21 14,797

每

每

每

每

每

14,797

Bank loans

25

(944)

(944)

(944)

(944)

(944)

(3,200)

(7,920)

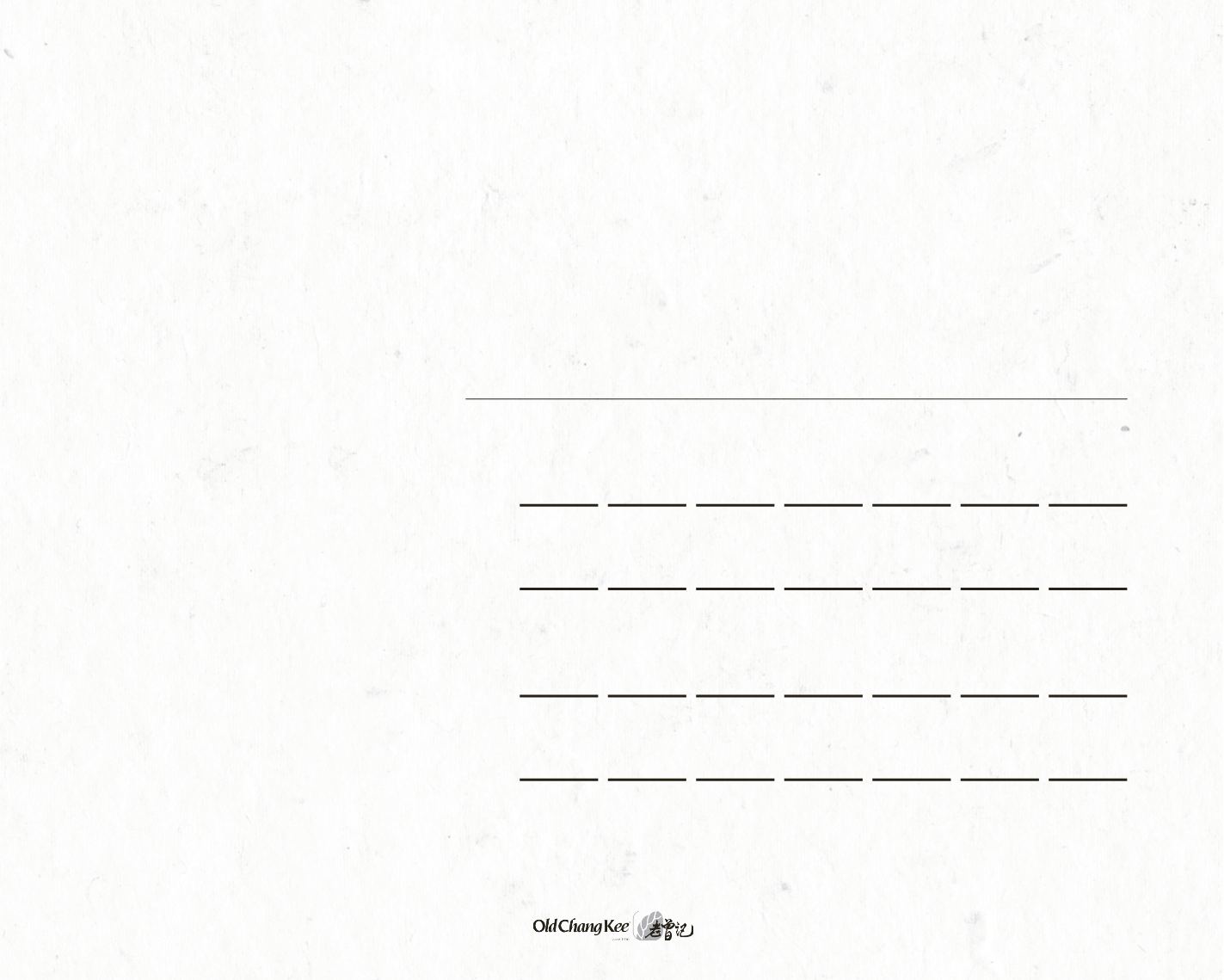

2015

Fixed rate

Short-term deposits

21

1,021

每

每

每

每

每

1,021

Obligations under finance leases

30(c)

(110)

(112)

(117)

(114)

(46)

每

(499)

Floating rate

Cash at banks

21 19,070

每

每

每

每

每

19,070

Bank loans

25

(897)

(1,234)

(1,234)

(1,234)

(1,234)

(2,395)

(8,228)

Interests on financial instruments at fixed rates are fixed until the maturity of the instrument. The other financial instruments of the

Group that are not included in the above table are not subject to interest rate risks.