129

A N N U A L R E P O R T 2 0 1 6

For the Financial Year Ended 31 March 2016

NOTES TO THE

FINANCIAL STATEMENTS

33.

Financial risk management objectives and policies (cont*d)

(b)

Liquidity risk (cont*d)

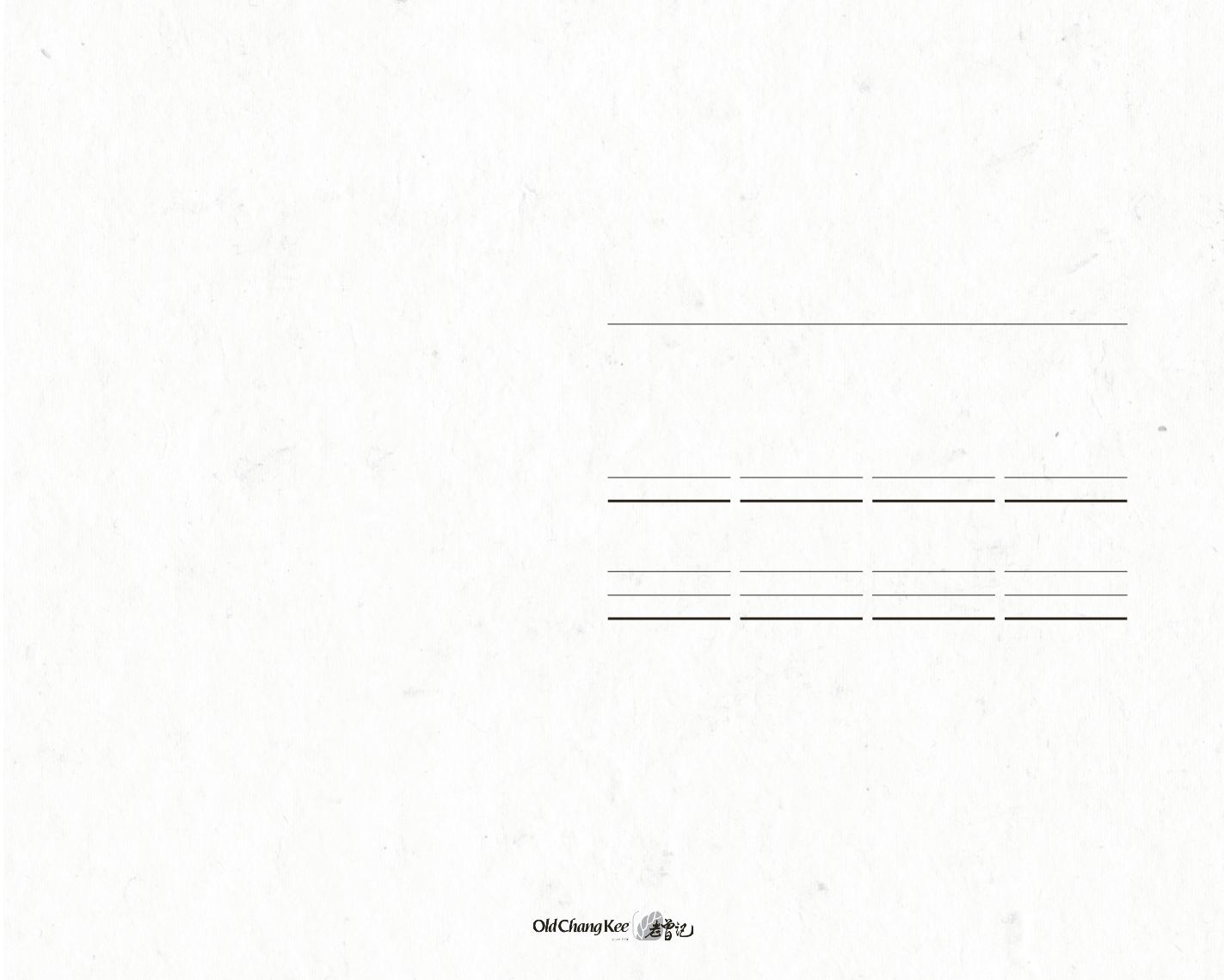

Company

1 year or less

1 to 5 years

Over 5 years

Total

$*000

$*000

$*000

$*000

2015

Financial assets:

Amount due from subsidiaries

3,570

每

每

3,570

Amount due from associates

每

每

每

每

Cash and bank balances

10,508

每

每

10,508

Available-for-sale financial assets

每

每

273

273

Total undiscounted financial assets

14,078

每

273

14,351

Financial liabilities:

Trade and other payables

1,329

每

每

1,329

Total undiscounted financial liabilities

1,329

每

每

1,329

Total net undiscounted financial assets

12,749

每

273

13,022

(c)

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of the Group*s financial instruments will fluctuate because of changes

in market interest rates. The Company obtains financing through bank loans and finance lease facilities. The Company*s policy is to

obtain the most favourable interest rates available without increasing its interest risk exposure. All the Group*s financial assets and

liabilities at floating rates are contractually repriced at intervals of less than 6 months (2015: less than 6 months) from the end of the

reporting period.