113

A N N U A L R E P O R T 2 0 1 6

For the Financial Year Ended 31 March 2016

NOTES TO THE

FINANCIAL STATEMENTS

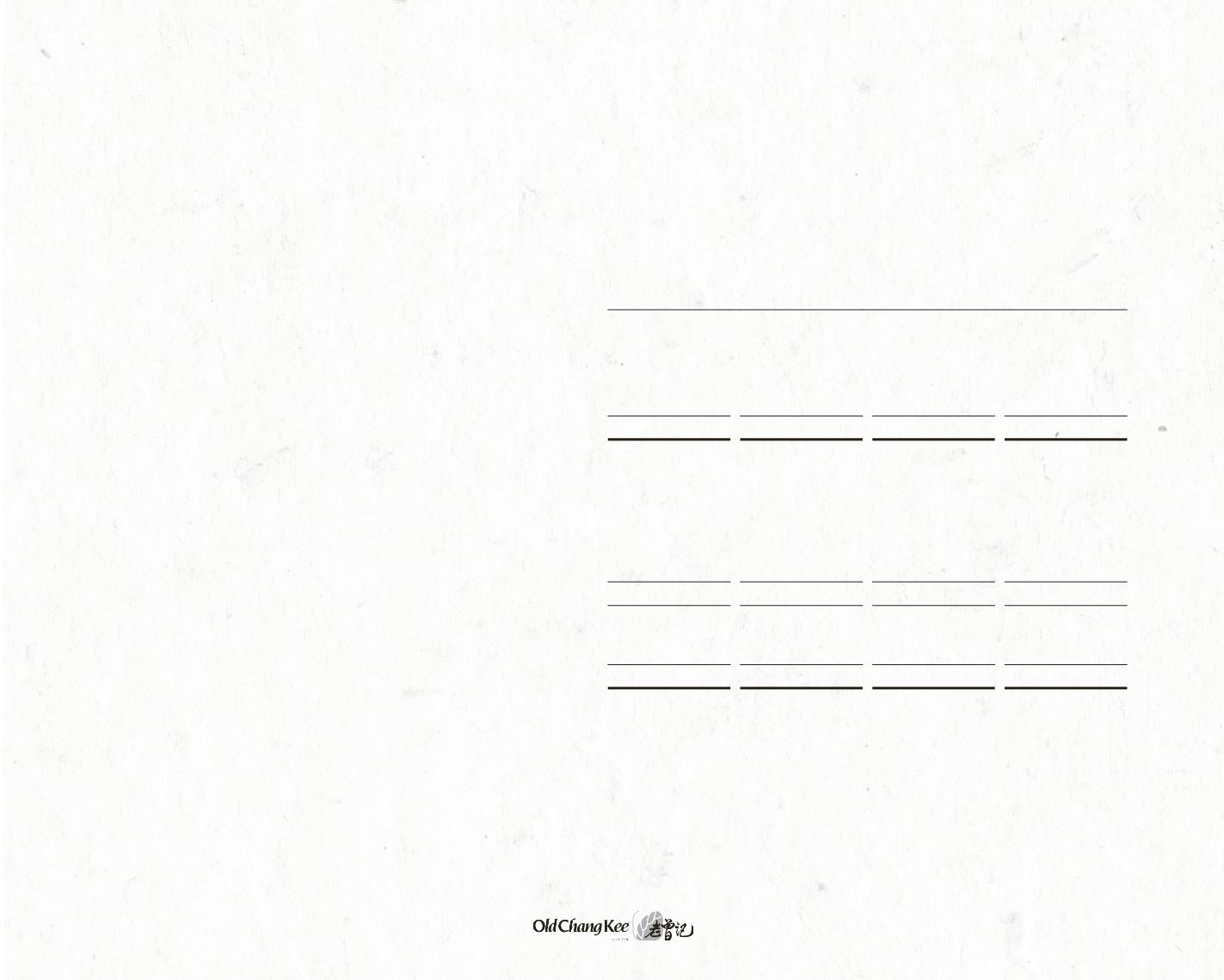

27.

Deferred tax liabilities

Group

Company

2016

2015

2016

2015

$*000

$*000

$*000

$*000

Balance at beginning of year

1,082

1,293

每

每

Movement in temporary difference

582

(106)

每

每

Deferred tax on revaluation of freehold land and buildings

每

(102)

每

每

Exchange difference

(2)

(3)

每

每

Balance at end of year

1,662

1,082

每

每

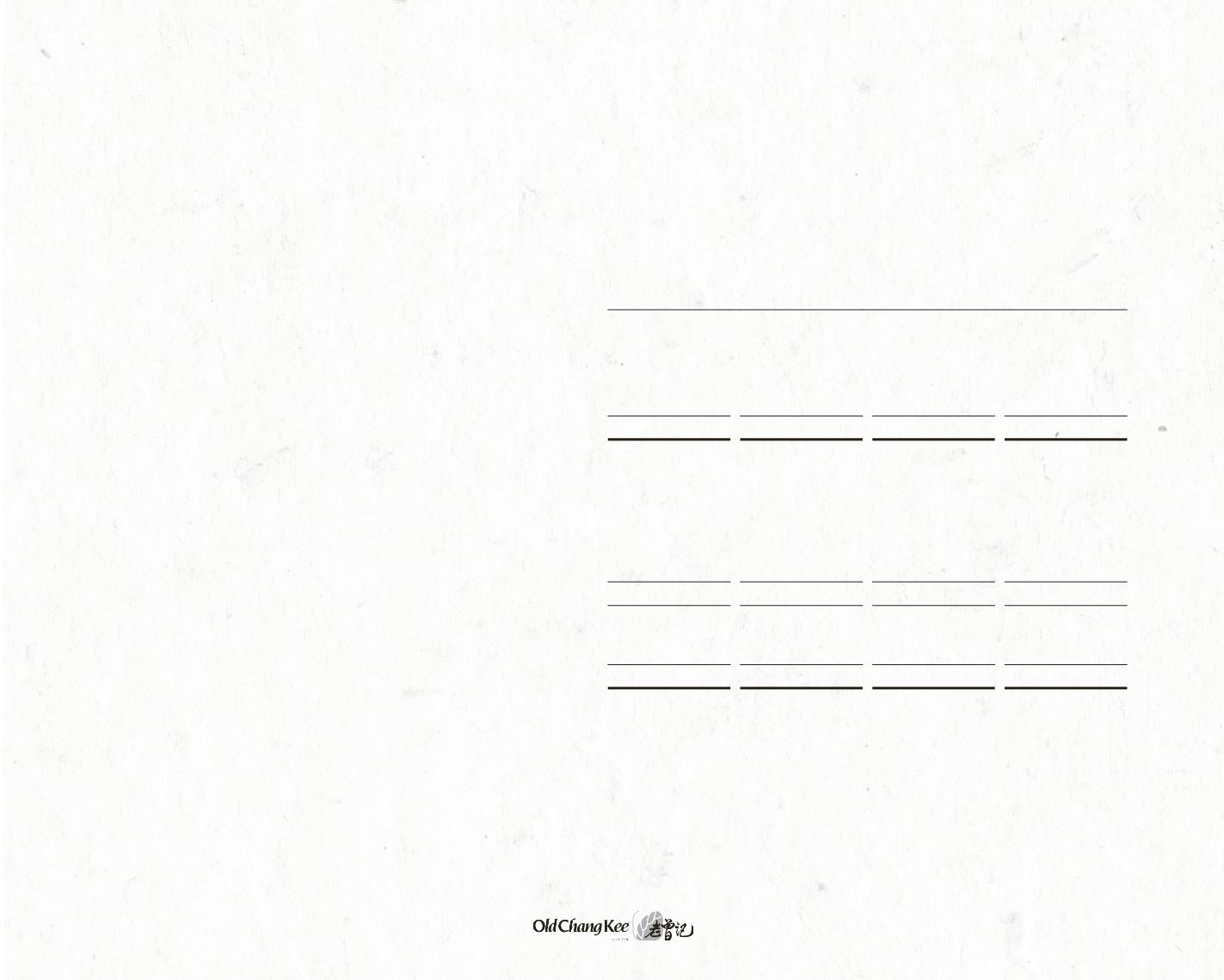

Deferred taxation comprises:

Deferred tax liabilities:

Excess of net book value over tax base of plant and equipment

(1,308)

(727)

每

每

Deferred tax on revaluation of freehold land and buildings

(402)

(402)

每

每

Exchange difference

(1)

(3)

每

每

(1,711)

(1,132)

每

每

Deferred tax assets:

Provisions

49

50

每

每

(1,662)

(1,082)

每

每