A N N U A L R E P O R T 2 0 1 6

112

NOTES TO THE

FINANCIAL STATEMENTS

For the Financial Year Ended 31 March 2016

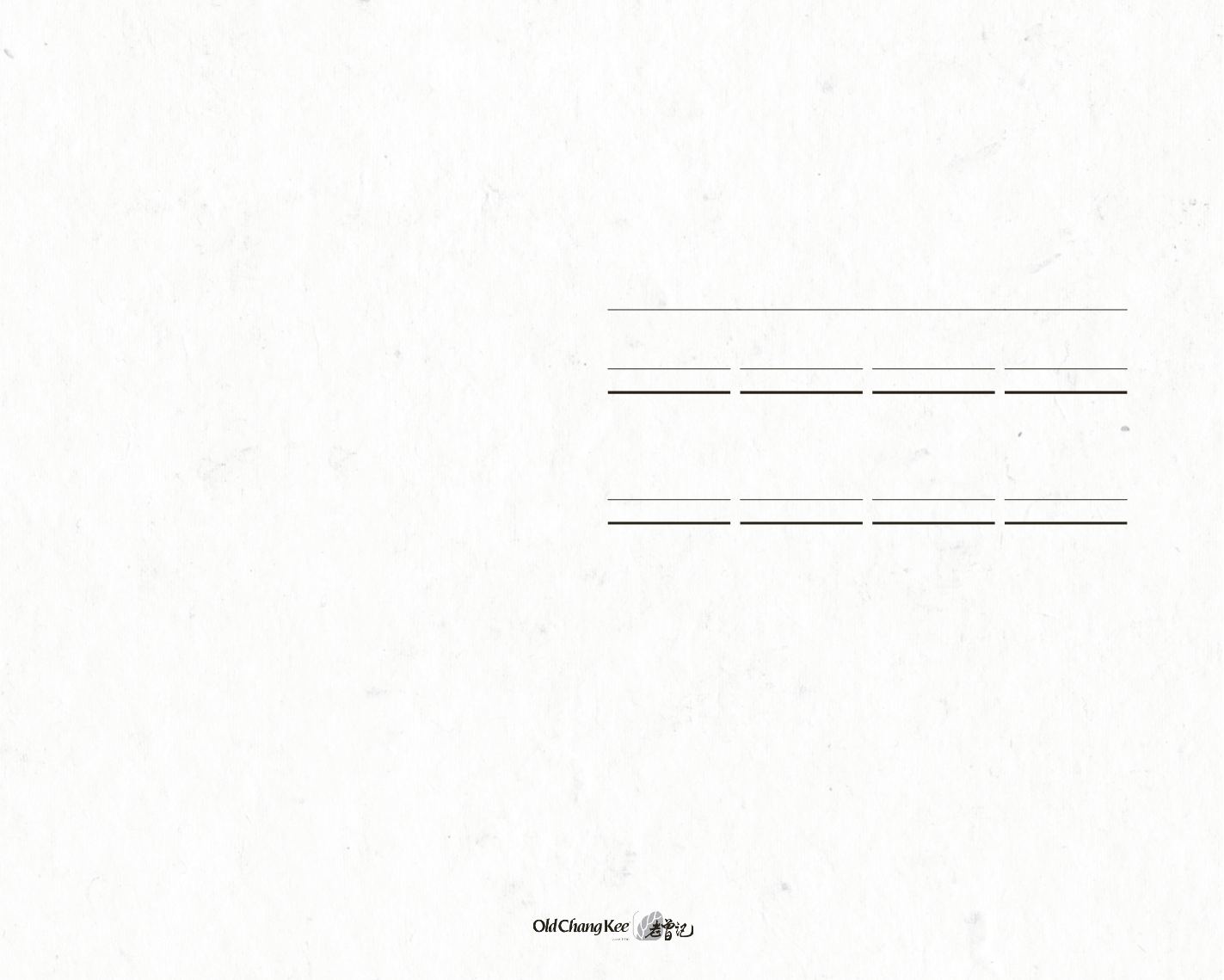

25.

Bank loans

Group

Company

2016

2015

2016

2015

$*000

$*000

$*000

$*000

Current

944

897

每

每

Non-current

6,976

7,331

每

每

7,920

8,228

每

每

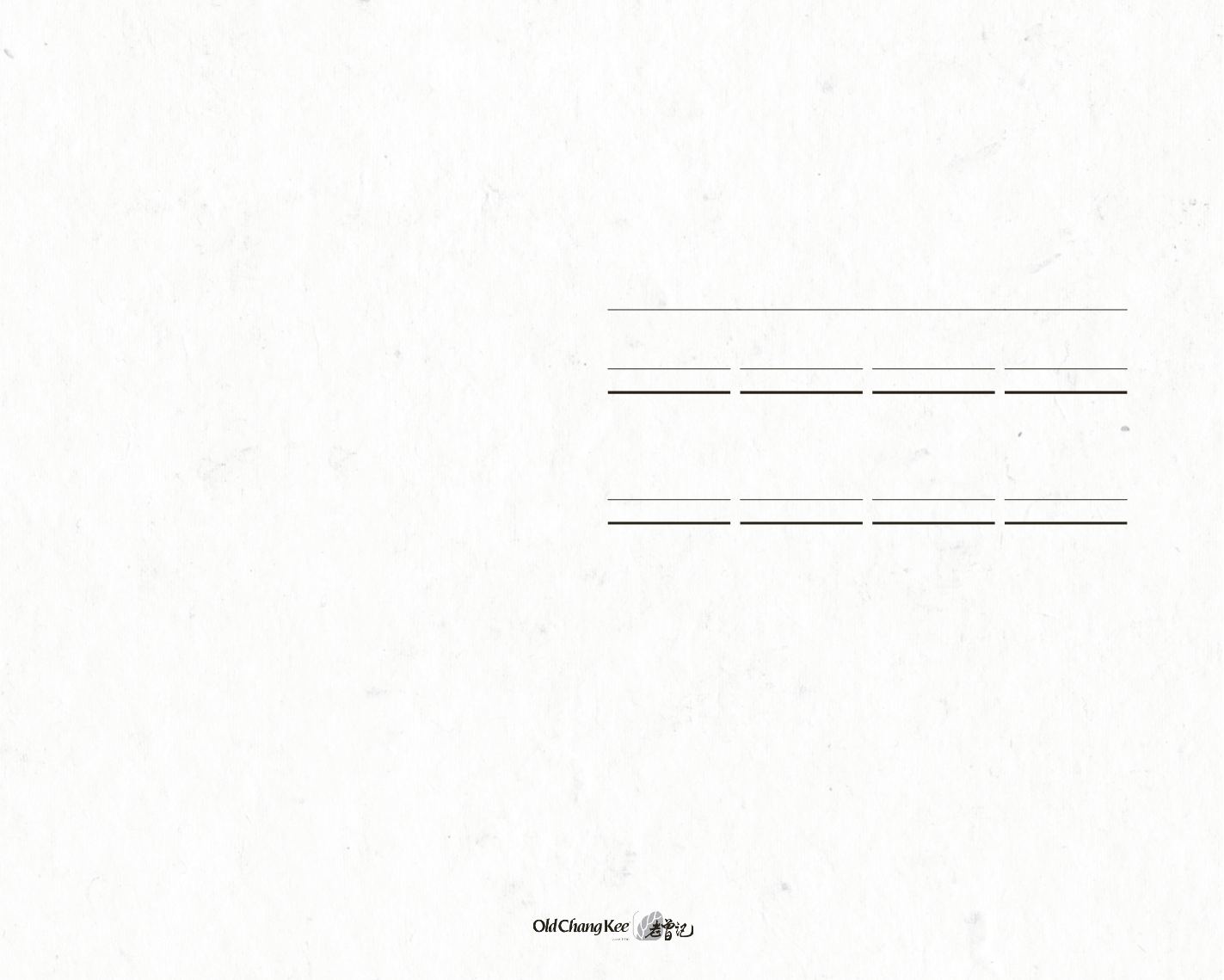

Bank loans comprise:

Loan 1

2,296

2,632

每

每

Loan 2

641

729

每

每

Loan 3

4,983

4,867

每

每

7,920

8,228

每

每

Loan 1: The loan bears interest rate at 1.3% per annum above the bank*s prevailing cost of funds. This loan, denominated in Singapore

Dollars, is secured by a first legal mortgage over certain of the Group*s leasehold buildings (Note 11) and corporate guarantee provided by

the Company. The loan is repayable over 119 monthly installments from February 2013 and a final installment on 2 January 2023.

Loan 2: The loan bears interest rate at 1.5% per annum above the bank*s prevailing cost of funds. This loan, denominated in Singapore

Dollars, is secured by a first legal mortgage over certain of the Group*s leasehold buildings (Note 11) and corporate guarantee provided by

the Company. The loan is repayable over 119 monthly installments from February 2014 and a final installment on 1 January 2024.

Loan 3: The loan bears interest rate at 1.3% per annum above the bank*s prevailing cost of funds. This loan, denominated in Singapore

Dollars, is secured by a first legal mortgage over certain of the Group*s leasehold buildings (Note 11) and corporate guarantee provided by

the Company. The loan is repayable over 119 monthly installments from September 2015 and a final installment on 1 October 2025.

26.

Finance lease liabilities (Note 30(c))

Finance lease liabilities are secured by a charge over the leased assets (Note 11). The average discount rate implicit in the leases ranges

from 2.9% to 3.8% (2015: 2.9% to 5.58%) per annum.